Chinese PV module manufacturers are quickly gaining global market share, capitalizing on the global economic downturn by engaging their low-cost production structures to compete with rival American and European companies. Recent data from GTM Research reveal that China’s global module production, as measured in MW-dc, grew from 30 percent of the global total in 2007 to 40 percent in 2009. China’s four largest PV module producers -- Suntech Power, Yingli Green Energy, Trina Solar, and Solarfun -- all rank in the top ten PV module producers globally, accounting for a total of 1,941 MW-dc of module production in 2009.

Yet even as Chinese PV manufacturing companies increase global market share and ramp up production, demand within China itself has been limited. For Suntech, Yingli, Trina, and Solarfun, revenues from China have represented only a small fraction of total revenues, and this proportion has experienced little, if any, growth over the years 2007, 2008, and 2009. Despite government initiatives such as Golden Sun and the Solar Rooftop program, China has been slow to make good on its ambitious stated plans for domestic solar energy development. Given that Chinese PV companies are making minimal domestic sales, which foreign countries and regions have emerged instead as their key markets?

In July's issue of PV News (available by subscription from Greentech Media), GTM Research analysts Shayle Kann and Shanna Hoversten, reveal the market exposure of leading Chinese module suppliers, with detailed data for Trina, Suntech Power, Yingli and Solarfun. A few findings:

- Suntech Power has found markets in Italy, France, Japan, and the Benelux region became more prominent in 2009, filling the void left by Spain, while Germany still represented 41.4% revenue. Suntech’s market in the United States also grew steadily in 2007 (6 percent), 2008 (8 percent), and 2009 (10 percent), while China came in at only 4.5 percent in 2009 for the company.

- Yingli has consistently derived the majority of its revenue from Europe. The most significant shift in revenue distribution over the past three years has been the dramatic reduction of Spain’s prominence, as Yingli’s German market has simultaneously expanded. In 2007 Spain accounted for 64 percent of revenues, declining to 40% in 2008, and falling to only 6 percent in 2009. Meanwhile, German revenues grew from 21 percent in 2007, to 41 percent in 2008, finally reaching 63 percent in 2009.

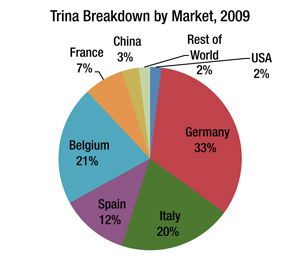

- Europe has consistently been Trina Solar’s primary market, with the largest proportion of revenues derived from Germany, Spain, and Italy. Belgium became a substantial market for Trina in 2008 and 2009, at 14% and 21% of revenues respectively, thus becoming the company’s second largest market in 2009 behind Germany. Despite this country level diversification, Trina has failed to expand its primary markets much outside of Europe. China itself remains a very small share of Trina’s revenue, hovering between 2% and 4% during the time period. The United States has also occupied very little of Trina’s market share, peaking at 2% in 2009. In 2010, however, Trina expects to expand its revenue base in the U.S. up to 14% of total revenues.

- Solarfun has been heavily reliant on the German market throughout the company’s lifetime. Revenues from Germany accounted for around 50% of Solarfun’s total revenues in 2007 and 2008, jumping up to a 71% share of total revenues in 2009. For the first quarter of 2010 revenues from German customers increased to 81%, however, analysts predict this figure will decline in subsequent quarters with the reduction of the German feed-in tariff.

- These data show an increasingly broad global presence for Chinese module manufacturers. Although the demand for solar capacity has risen annually in China, from 20 MW installed capacity in 2007, to 40 MW in 2008, and finally 160 MW in 2009 (Source: China National Development and Reform Commission), this growth has not been reflected by a growing Chinese revenue base for Suntech, Yingli, Trina, or Solarfun.

PV News is Greentech Media's monthly market newsletter for the solar industry, and continues to build on its nearly 30-year legacy as a leading source of unvarnished analysis and opinion established by Paul Maycock and carried on by Travis Bradford of the Prometheus Institute for Sustainable Development. Recent issues included detailed demand analysis of the Italian PV market, an annual global cell and module production dataset, analysis of China's burgeoning solar market, a thin film market update, and analysis of the BIPV market and China's polysilicon market.