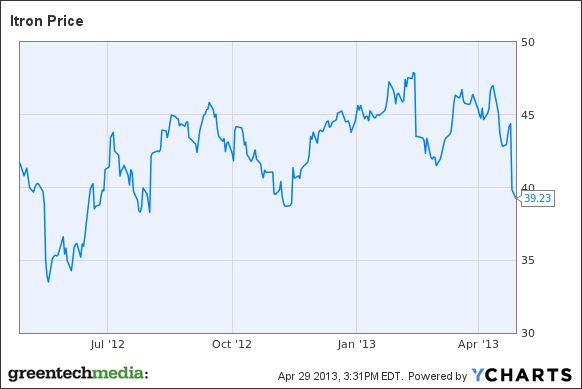

Itron (ITRI), one of the last remaining publicly traded smart meter giants, saw its share price tumble Friday, after reporting first-quarter revenue and earnings that fell short of even its reduced expectations for the start of the year.

The Liberty Lake, Wash.-based company reported revenue of $447.5 million, below Wall Street projections of $466.6 million and down $119 million from the same quarter last year. First-quarter earnings fell to $2.6 million, or 6 cents per share, compared with net income of $25 million, or 63 cents per share, during the same period in 2012, and free cash flow for the quarter fell to negative $14 million, compared to positive $42 million in the first quarter of 2012.

Itron shares had fallen more than 10 percent to $40 in Friday trading. Consider it the first casualty of what’s expected to be a tough year for the smart meter industry. In North America, where $4.5 billion in smart meter stimulus grants that boosted business in 2011 and 2012 have largely been spent, only a handful of potential multi-million-endpoint contracts remain, and regulators are clamping down on new plans. In Europe, macroeconomic and political uncertainties, as well as immature standards, have delayed big nationwide efforts in France and Spain. In Asia, massive markets beckon, but pilot projects are still the norm.

Even so, Itron CEO Philip Mezey said in a Friday conference call that “the challenges we are facing in 2013 are largely issues of timing,” rather than signs of a broader economic slowdown across its global markets. The company predicts a slow first half of 2013, picking up in the second half to show improvement on the first quarter’s disappointing results, and stable core business and backlog to hold it through an expected pickup in business in 2014, he said.

Itron has seen a slowdown in revenues due to the run-out of its top five projects using its OpenWay smart metering technology. Those include CenterPoint Energy, Southern California Edison and San Diego Gas & Electric, which have largely deployed all their Itron meters, as well as Canadian customer BC Hydro, which is in the midst of rolling out about 2 million smart electric meters, and Detroit Edison, which is considering accelerating its deployment schedule for its remaining 2.2 million smart electric and gas meters, Mezey said.

At the same time, Itron COO John Holleran noted in Friday’s call that “we still face challenges in lowering our fixed costs fast enough to meet the fluctuating volumes” it expects from projects to come this year. Itron will “take actions to mitigate the impacts of slowing growth and pricing pressure to help preserve and improve our margins,” ranging from leaner manufacturing to sharper purchasing, he said.

On a regional basis, Latin America residential business fell, largely due to Brazil’s decision to ramp back its smart meter mandates, Mezey said. In Europe, Itron is awaiting tenders for projects from the likes of Iberdrola in Spain, ERDF in France, ESP in Ireland and the U.K.’s upcoming smart meter networking bids, which are set to move forward this year, he said. At the same time, Holleran noted that “some countries in Europe will continue to slow their spending and adopt austerity plans, and utilities won't be exempt.”

As for Asia, Itron and partners Panasonic and Cisco are competing for Tokyo Electric Power Co. (TEPCO)’s 5 million smart meter project set to get underway next year, Mezey said, giving it a foothold in what industry analysts expect to be nationwide smart meter rollout largely led by Japanese companies. Itron’s 5,000-meter pilot with partner Cisco and utility China Light and Power is proceeding apace, with better than 98 percent successful meter read rates in the “extremely complex environment” of Hong Kong, he said.

How are Itron's smart meter competitors faring in the general market slowdown? It's hard to say. Germany's Elster was taken private in a $2.2 billion transaction last year, and U.S.-based metering player Sensus is privately held as well. Landis+Gyr was bought by Toshiba for $2.2 billion last year, and was privately held before that, and General Electric's metering business is likewise obscured in its broader energy business.