Concentrating Photovoltaic (CPV) equipment vendor Concentrix was acquired by Soitec last week for about $50M from shareholders Good Energies and Abengoa Solar.

According to the press release, "Soitec is entering the fast-growing solar industry; capturing value through the system level; and expanding its revenue base as worldwide demand for CPV systems is anticipated to ramp up strongly in the coming years. Soitec’s technologies in engineered substrates are key to improving solar cell performance and therefore strongly complement Concentrix’s expertise in high-efficiency CPV systems for solar power plants...Additionally, the transaction includes access to the high-efficiency concentrator solar cell technologies from Fraunhofer ISE”.

Soitec said they expect the CPV market to grow at a CAGR of >100 per cent from 2010-2015.

CPV Has Its Positives and Negatives

At a recent CPV panel at Solar Power International in Anaheim in October, the CEOs of several CPV firms including Concentrix, made these points:

- CPV is just at the beginning of its cost curve. Concentrix' CEO Hansjörg Lerchenmüller sees CPV achieving costs of 30 cents per Watt in a few years.

- CPV with high-efficiency triple-junction solar cells behaves better than silicon in high temperatures.

- CPV doesn't require water like CSP and unlike CSP scales to smaller deployments.

- Notably, the price of capex for CPV is much less than that of other PV technologies: $0.10 to $0.15 per Watt compared to First Solar at about $1 per Watt and a-Si at about $3 per Watt.

- CPV is becoming a "bankable" and credible technology.

All of the CEOs expected the prices of the solar cells to drop. Lerchenmüller spoke of the parallel between those cells, which are essentially LEDs, having to follow the falling price trajectory of LEDs whether they come from Emcore, Spectrolab, Azure Space or one of the newcomers like Cyrium or Solar Junction.

But according to Greentech Media's recent report on CPV -- CPV: New Applications and Emerging Markets, "With relatively high costs, CPV is even more dependent than other solar technologies upon government subsidies and R&D funds. This creates a certain level of policy risk, which refers to the governmental will to support innovative solar technologies and the uncertainty that the market could disappear when governmental funding stops."

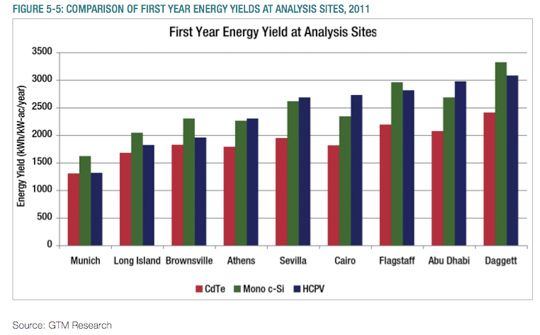

Also from that report is the following graph that shows CPV really hitting its energy harvest sweet-spot in the high sunlight regions like the US Southwest, Greece, and the Mideast.

Concentrix in Detail

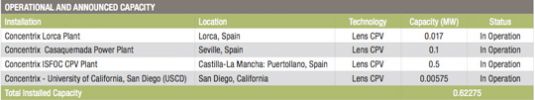

Concentrix expects 2009 revenues of $7.6 million, up about 50% from 2008. Lerchenmüller stated that Concentrix had installed 600 kW of CPV systems in Spain, demo systems in the US and Italy, and was working on a strong project pipeline. Concentrix claims to have about 25MW of annual CPV manufacturing capacity in place.

Here's a detailed list of systems deployed by Concentrix, also from GTM's CPV report.

The Deal

Concentrix has never publicly disclosed funding amounts from Abengoa, Fraunhofer or Good Energies. But building, staffing, and running a CPV equipment company over the last five years could not have been a cheap endeavor (Rival CPV firm SolFocus has taken more than $170 million in venture capital and is rumored to be looking for more funding). And it is safe to say that although Concentrix lives to fight another day, this is not a successful exit for the investors. It's more like an escape. And after the acquisition closes in January 2010, Soitec and minority shareholders will have to put another $28.5 million into the company.

More details in the Soitec Powerpoint review of the deal.

Here is the text of an email exchange with the CEO of Concentrix, Hansjörg Lerchenmüller:

GTM: What is the strategic value of Soitec as new owner?

Concentrix: Soitec is the leading innovator in what is called “engineered substrates” (e.g. Silicon-on-Insulator technology: thin semiconductor layers bonded to other semiconductor substrates); combining engineered substrates with III-V multi-junction solar cells offers a huge potential for both increase of cell efficiency and cost reduction.

GTM: What can Soitec bring to the party?

Concentrix: Apart from the technical synergy on the cell side there are two elements: (i) Soitec perfectly knows how to grow fast (including how to finance such growth) and will add financial strength to the company and (ii) we will also benefit from Soitec’s manufacturing expertise and their experience of a fast introduction of new products into manufacturing

GTM: Are you staying on as CEO?

Concentrix: Yes. Also the management team will stay on board.

GTM: Will Soitec be trying to build Triple-Junction solar cells?

Concentrix: Yes, as indicated above this is clearly on the roadmap of Soitec. As part of the deal Soitec entered into a strategic alliance with Fraunhofer ISE (having a 20 year track record in III-V cells) and French CEA-Leti (one of the main European applied research centers in electronics) to develop a new cell generation.

He also said, "I am very happy about the deal, this will certainly boost our growth much more than a normal VC round."

It is at this point I did a spit take. Huh?

I don't understand. When are results of an acquisition equivalent to a VC round?

From now on it's about being just another business unit within Soitec. With dissatisfied former investors and little return for existing shareholders in and out of the company.

The willingness of Concentrix and their investors to accept this weak result at the dawn of a "100 per cent CAGR" CPV era and the beginning of what should be a very acquisitive year suggests some fundamental problems within Concentrix or within the lead investors. Or a lack of faith in the CPV market.